You’ve never seen flexible remuneration like this before

Make the most of a flexible remuneration plan tailored specifically to you. Discover how the innovation and simplicity of Cobee will help your teams enjoy a larger salary and boost well-being.

What is Flexible Remuneration?

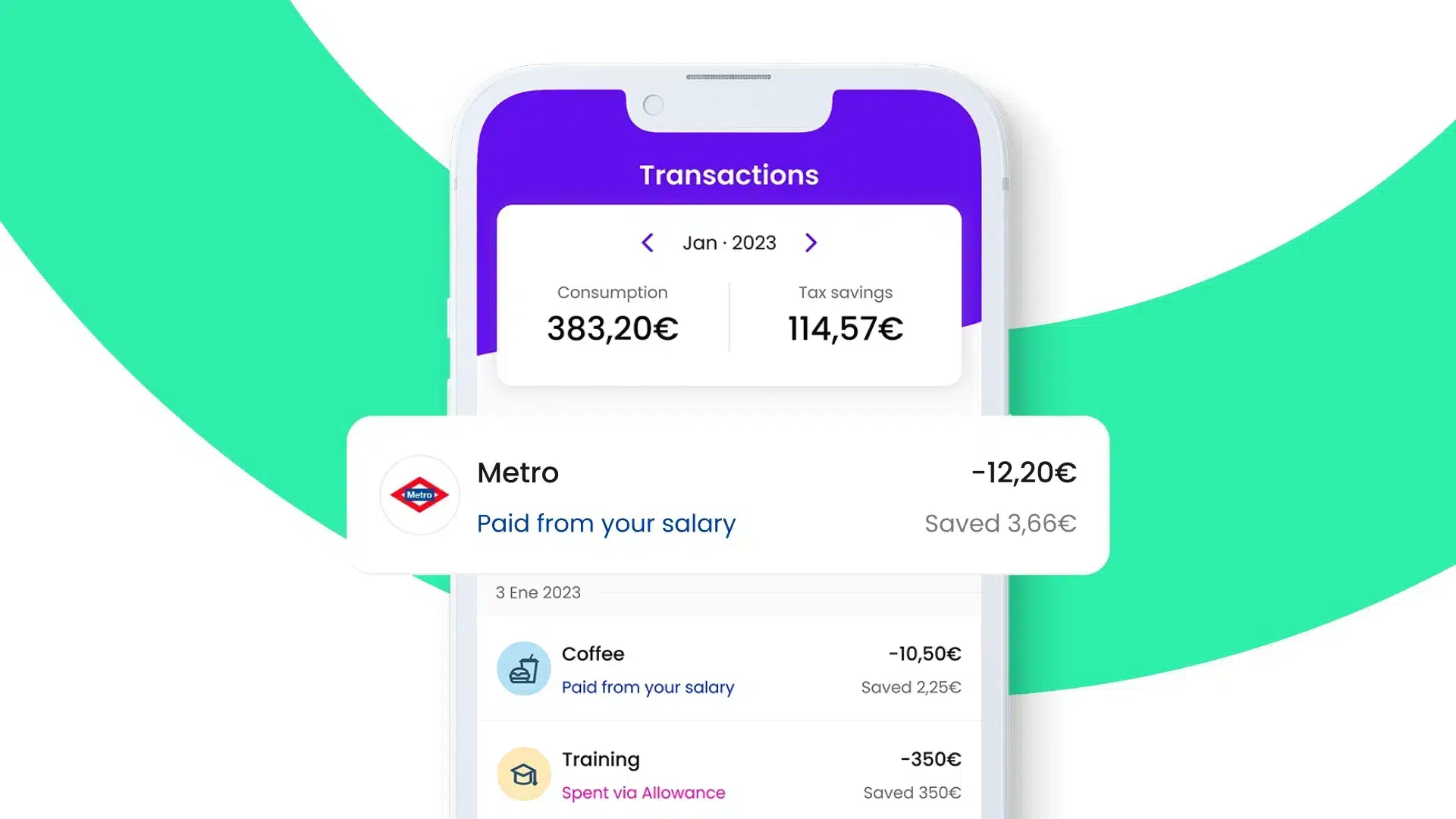

Flexible Remuneration is a form of remuneration that lets an employee allocate up to 30% of their gross salary to the consumption of products or services at below-market price.

By paying for them out of their gross salary, employees benefit from total or partial tax deductions that will let them lower the figure used to calculate their Personal Income Tax. In other words, the advantages of Flexible Remuneration will translate into a significant saving each month that will equate to a net annual salary of up to 15% more.

Over 70% of companies have already committed to Flexible Remuneration as a way to improve conditions for their teams. This type of remuneration offers a three-fold advantage: it enables improvements to the net salaries paid to the workforce; it does not increase wage costs; and it improves workforce motivation and well-being.

Thousands of companies just like yours are already using Cobee every day

The advantages of Flexible Remuneration for your company

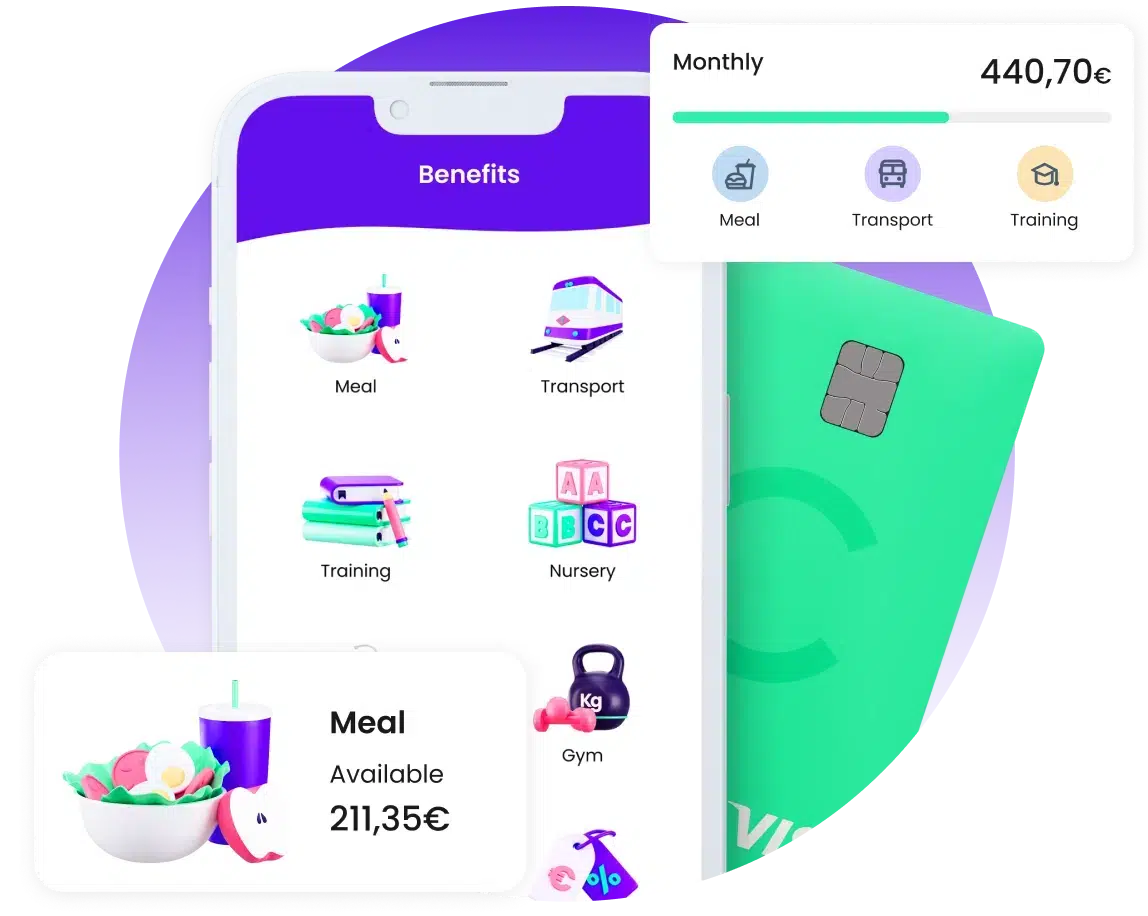

All-in-one

All the benefits in one stand-alone solution

Flexibility

Plans that are tailored to each individual

100% digital

Service via the website and app

Innovation

A single card for all the services

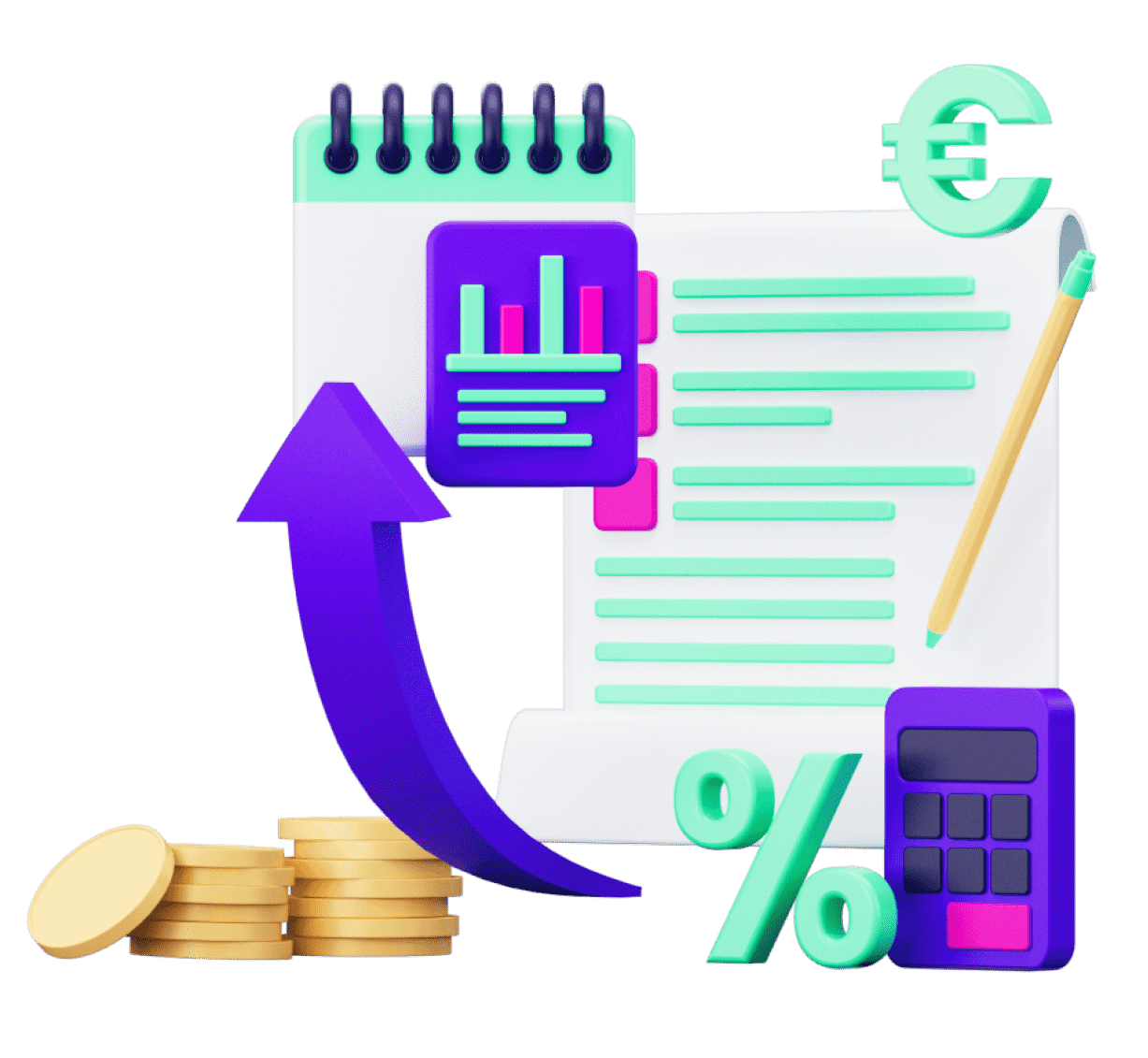

Let your company and your teams save money with Flexible Remuneration

By adopting a Flexible Remuneration plan with Cobee, your company will save a lot of time by having just one partner and drastically reducing the administrative workload.

What’s more, you will obtain a return on your investment of up to 20X thanks to the efficiency of our plans: for every €1 you invest, you will be able to recoup up to €20 through the Cobee effect on the salaries paid to your team and the workload reduction for your human resources department.

In turn, employees who take up the Flexible Remuneration plans and make use of all their benefits could enjoy a salary increase of up to 15% per year by improving wage performance through tax saving optimisation.

Calculate your savings now with our Flexible Remuneration simulator

Discover in just a minute everything you are going to save in your company with Cobee's Flexible Remuneration plans

All-in-one

Total control over your Flexible Remuneration plan

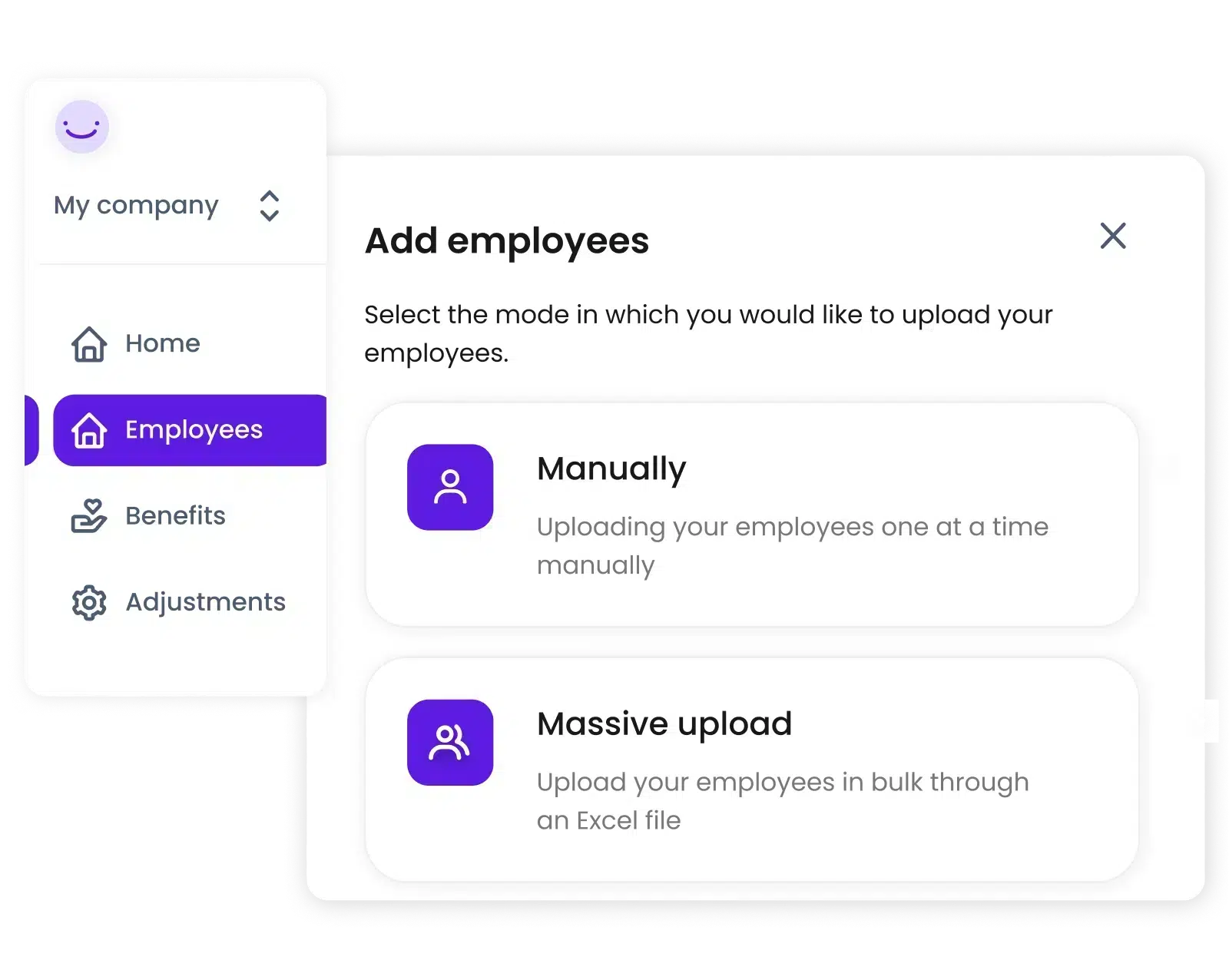

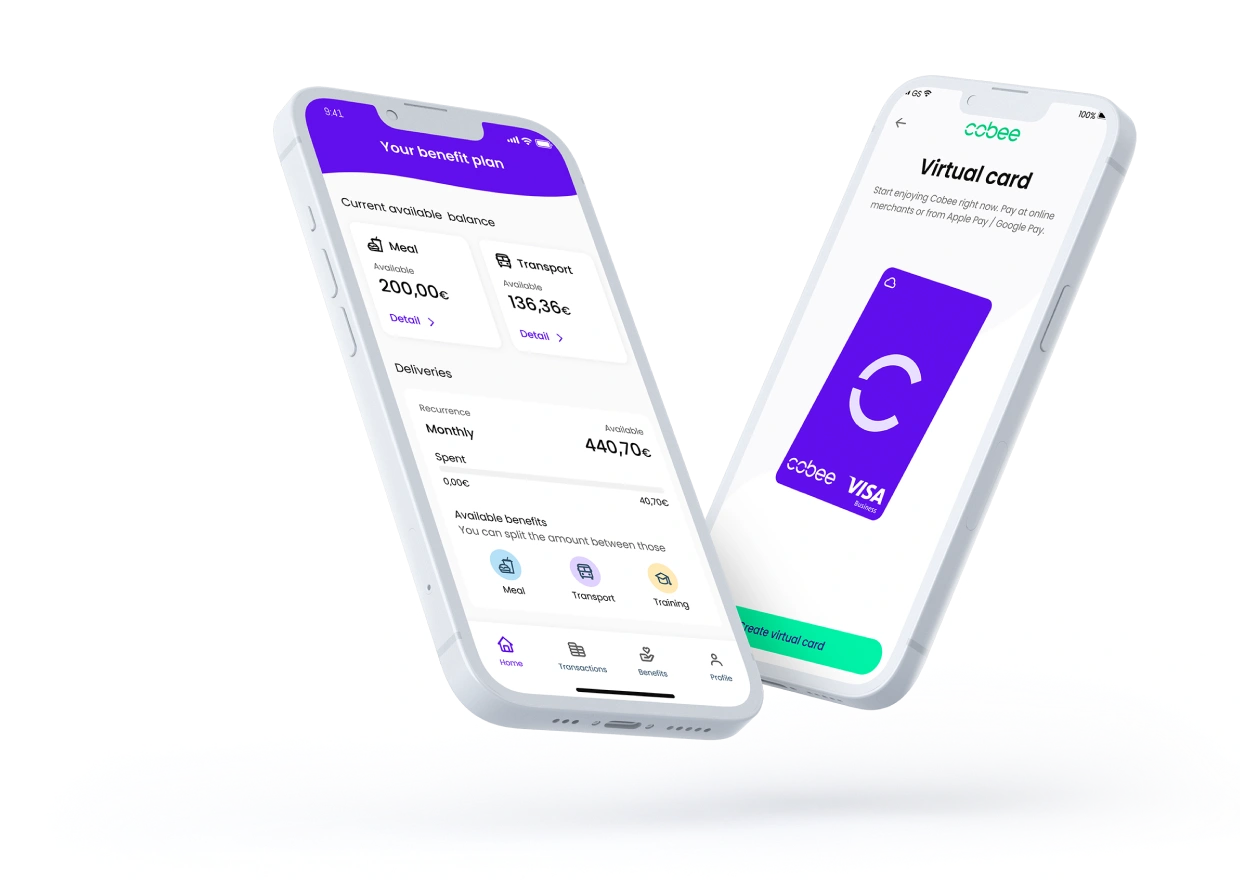

- A digital, intuitive and centralised platform based on a website and an app.

- Forget about depending on third parties, no middlemen and no fees.

- Comprehensive guidance and support throughout the whole process.

Flexibility

A fully personalised compensation system

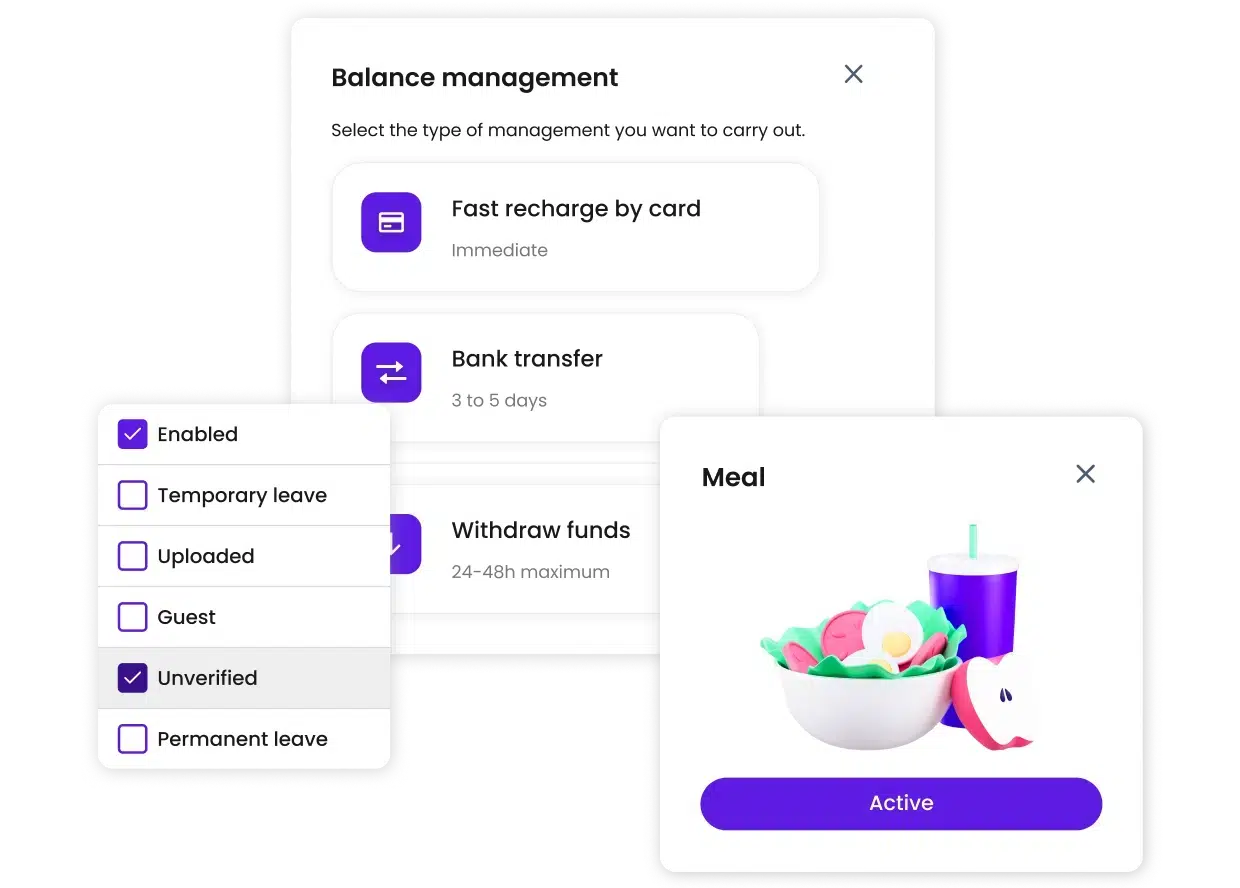

- Activate and deactivate benefits with a simple click, it’s as simple as that.

- Create different groups and add or remove people to/from your teams whenever you want.

- Check what’s being used and who is using it in real time.

100% digital

Save time with automated processes and tasks

- Automated payroll process and fiscal caps.

- With a contactless virtual Visa card for accessing all the benefits.

- Access comprehensive information at the click of a button on the website and app.

Innovation

Lessen the fiscal burden and attract the best talent to your company

- Improve your employer branding with the flexibility that professionals are looking for today.

- Help your workforce improve wage performance without increasing labour costs.

- Adapt your plans to the needs that arise at any given time with complete freedom.

Smart remuneration

Happiness for your teams with more flexible compensation

All the benefits that your teams may need, Cobee makes them available for you.

Hassle-free: all the services at the click of a button.

The all-in-one platform that will lessen your daily burden

![]() Integrating benefits into one single platform

Integrating benefits into one single platform

![]() Activating people with a single click

Activating people with a single click

![]() Onboarding and offboarding in the same place

Onboarding and offboarding in the same place

![]() Automated payroll process

Automated payroll process

![]() All the info in real time

All the info in real time

![]() Constant incident tracking

Constant incident tracking

![]() Tailored and direct support

Tailored and direct support

Configure the flexible remuneration plan that best suits you

What do our customers think about Flexible Remuneration?

Do you want to know why more and more companies are trusting Cobee to create their flexible remuneration plans? Here are a few examples

The world has changed, has your company changed with it?

People’s needs have changed. Adapt your company’s salary sacrifice plan to each member of your team

Request a demo

FAQs about flexible remuneration

When looking or applying for a certain job, candidates are no longer just focused on salary brackets or the projects involved. What often tips the balance in favour or against a new career venture is something far more tangible and highly appreciated: the benefits offered by a company.

Besides the components tied to emotional compensation for attracting and keeping talent on board, Flexible Remuneration and company benefits are a big help in ensuring that employees identify with a company. These are some of the advantages that both company and employee can enjoy when adopting a Flexible Remuneration system:

Advantages for the employee

- Saving money in the short and long term

Flexible Remuneration lets you reduce a whole series of regular expenses considerably. Whether they be daily expenses like meals (for which an average wage earner would reduce spending from €12 to approximately €8, for example) or more long-term expenses like pension plans (allocating a monthly amount with its corresponding tax exemption towards future savings).

An average annual salary, which according to the Spanish National Statistics Institute (INE) stands at a little over €23,600, could obtain a saving of almost €2,240 under a salary sacrifice plan because the Personal Income Tax withholding would fall from close on 12% to approximately 4% thanks to a lower annual gross salary and corresponding taxable base.

- Freedom to choose products and amounts

Employees stand at the centre of this system. For that reason, you can always choose whether you want to take up the plan offered by your company or not and decide which products you want to enjoy.

The success of any Flexible Remuneration plan most often depends on the ability to offer flexibility to the team in terms of setting up and using their Flexible Remuneration plan.

- Work-life balance

Creating a good atmosphere leads to uptake of these plans and loyalty to the company. When a team feels valued and knows that a department of the company is working on their well-being, it feels more closely tied to the company.

- Sense of belonging to the company

The workforce is made aware that their company, and specifically its human resources team, is making an effort to offer better conditions. Offering and knowing how to properly communicate a Flexible Remuneration plan will boost commitment to the company and stability within the company.

Advantages for the company

- Improved salaries at no additional labour cost

Flexible Remuneration lets a workforce earn more disposable income without that representing higher labour costs for the company. Furthermore, this increase will come in a format that employees will appreciate because it is spent on products they would buy every day anyway.

- Improved employer branding

Flexible Remuneration has an impact on the company brand at multiple levels, but mostly because it strengthens, confirms and builds the corporate culture at our company.

Putting a product in the hands of our employees that they use regularly and sometimes have no choice over, such as transport or nursery, but with a clear discount, leads to increased well-being. This product stands as a visible embodiment of all the effort made by the human resources department to boost the corporate culture at the company.

- Improved employee well-being and productivity

The corporate culture reflected in a Flexible Remuneration plan has a visible impact on raising awareness among employees about the commitments made by the company, leading to increased motivation. Moreover, a number of little things—like everyone having the same card—enhance the time that employees spend together, such as team meals out or ordering take away food deliveries.

All these factors have a positive impact on building a sense of belonging that translates into reduced employee turnover.

- Improved salary competitiveness

In more monetary terms, the salary continues to be the most important factor when someone has to choose between one project or another. Flexible Remuneration lets you earn more without that costing the company more.

Furthermore, it leads to what is known as remuneration efficiency; in other words, not only are people paid more but they are paid better through an optimised system.

- A huge benefit that is easily implemented

Flexible Remuneration should not impose a heavy workload. The solutions that exist in the market for all sorts of companies are designed to not give us a huge headache. For example, they are incorporated into the payroll system and predict Personal Income Tax figures based on the salary earned by each individual.

The current limit set by the Spanish Social Security system for payment in kind stands at 30% of the gross annual salary, both for Company Benefits and Salary Sacrifice. Any benefits over this percentage will be taxed at the standard withholding percentage defined for the type of contract in question.

Both are tax-exempt, in this case from Personal Income Tax for the employee and Corporate Income Tax for the company.

The products that are usually offered under either Salary Sacrifice or Company Benefit schemes because they are fully or partially exempt from Personal Income Tax are: Meals, Transport, Training, Health Insurance, Retirement or Life Insurance, IT Equipment, Nursery, Pension Plans, Shares and Vehicle Leasing.

When making use of Salary Sacrifice, the employee will see their taxable base for the payment of Personal Income Tax be reduced each month. In other words, they will pay less tax because the figure used for calculating that tax will be lower after spending certain amounts directly from their gross salary.

For example, if a user spends €220 a month on their meal vouchers, that amount will be deducted from their taxable base that month and they will be taxed for Personal Income Tax on their gross salary minus that amount.

By making use of all the benefits that can be added to a Salary Sacrifice plan, an employee can effectively increase their salary by up to 15% per year.

A wide range of products can be included in a Salary Sacrifice plan and these will vary depending on the needs of each company or team. With Cobee, you can configure whatever plan you need for your company or even create different plans to personalise the experience as much as possible.

The products you can add to a Salary Sacrifice plan include travel passes, meal vouchers, nursery vouchers, health insurance, life insurance, pension plans and vehicle leasing, among others.

Furthermore, you can also configure Salary Sacrifice plans with other types of benefits that are not tax-exempt, such as physical well-being, discount coupons or psychological care, among others.

Using Salary Sacrifice has absolutely no impact whatsoever on the amounts paid into the Social Security system by employees. The contribution base will remain unchanged even when consuming products via a Salary Sacrifice plan.