Life insurance that will protect your workforce

Protect your team and their families with one of the most highly valued benefits: group life insurance. Make the most of significant discounts and attract the best talent with this insurance coverage.

Get your life insurance with Cobee!

All the advantages of our

life insurance

Why choose company life insurance?

Group life insurance policies have become one of the most highly valued benefits at work.

A genuinely unique experience in the market

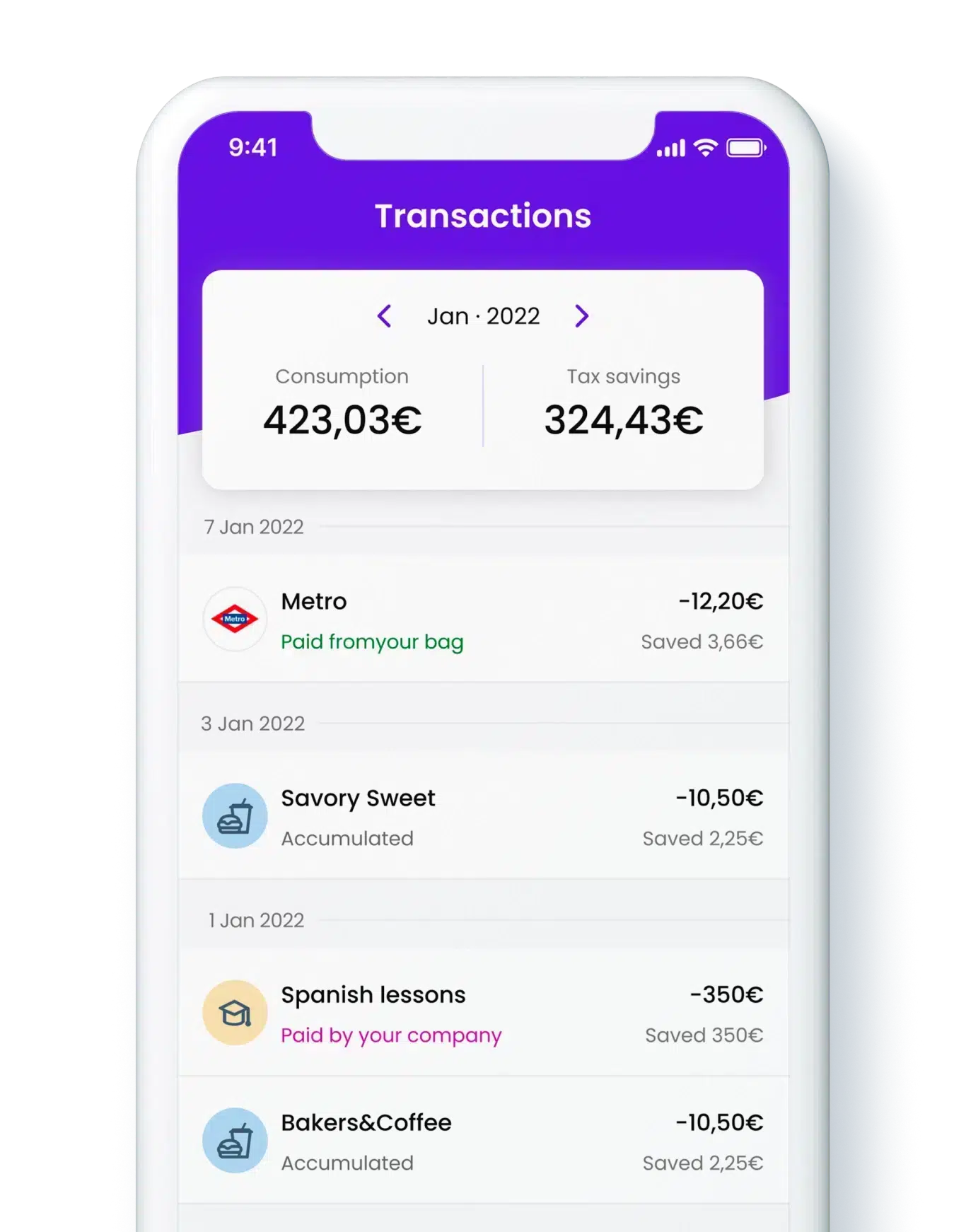

Simplicity

Fully digital, intuitive and easy-to-use platform

Flexibility

No need for monthly top-ups

Savings

Tax benefits for company and workforce

Innovation

Physical card, virtual card and app for managing your benefits

Create the perfect Benefits Plan for your company

Besides the life insurance, with Cobee you can create a personalised Benefits and Flexible Remuneration plan for your teams. Discover all the advantages!

What our customers say

Request a demo

FAQ

The Life Insurance Benefit is a policy that protects the family of the insured party in the event of death of the insured party, or the insured parties themselves in the event of total permanent invalidity, absolute permanent invalidity or disability.

Before taking out the insurance, the policyholder designates a beneficiary who will receive the compensation when the policyholder dies. Beneficiaries are usually spouses or descendants, although it is possible to designate ancestors or other relatives.

Companies mostly offer this product as a Company Benefit by fully subsidising the Life Insurance policy of their employees given that this is required nowadays under collective bargaining agreements with a company or at a sectoral level.

At present, this is the only available way to offer this benefit via Cobee and we recommend checking your collective bargaining agreement before contracting the product.

This benefit is not tax exempt, so employees are liable for income tax. Furthermore, as it is considered remuneration in kind, it is subject to its general limits. The total amount of remuneration in kind should not exceed 30% of the employee’s gross annual salary and the salary in cash must be higher than the minimum guaranteed interprofessional wage (SMI).

There are two types of life insurance depending on the number of insured parties:

Group life insurance is a policy that the company takes out on behalf of a group of employees.

Individual life insurance is a policy that is taken out by a person without being related to a company, freely choosing a more specific and open cover.

Three types of cover are offered:

Death: covers the death of the insured party.

Absolute Permanent Invalidity: covers the declaration of invalidity in cases where the employee is unable to perform any type of work.

Total Permanent Invalidity: covers the declaration of invalidity in cases where the employee is unable to perform current work.

Some insurance companies also include serious illnesses as an additional cover.