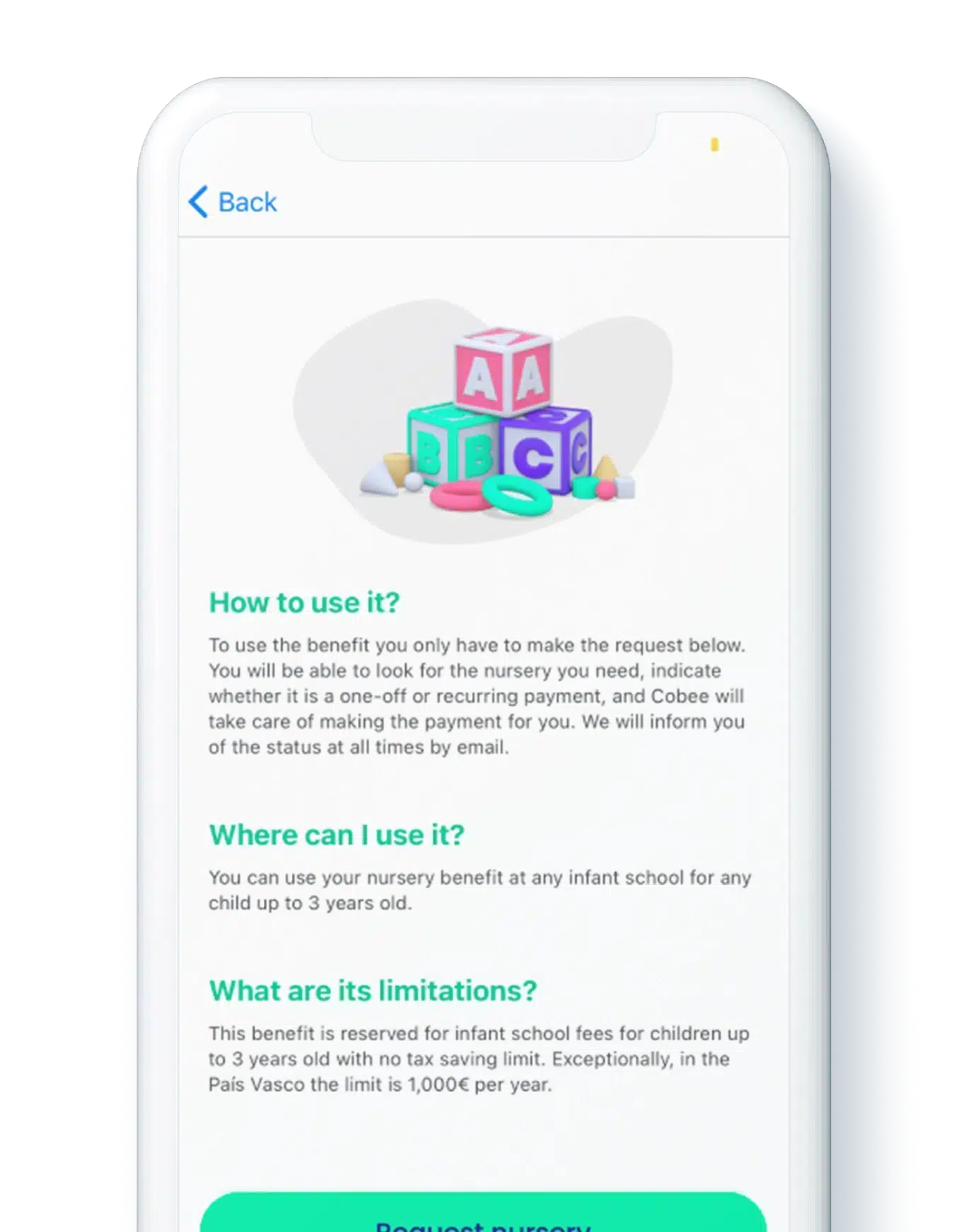

Nursery vouchers made easy

Activate the nursery benefit with Cobee at your company and help parents with babies aged 0-3 improve their work-life balance. Compatible with all nursery care services and with the deduction for working mums.

Start using Cobee and save money!

All the advantages of

the nursery voucher

Why choose the nursery voucher?

With the nursery voucher from Cobee, you won’t need to worry about any paperwork. We arrange the whole process from day one.

A genuinely unique experience in the market

Simplicity

Fully digital, intuitive and easy-to-use platform

Flexibility

No need for monthly top-ups

Savings

Tax benefits for company and workforce

Innovation

Physical card, virtual card and app for managing your benefits

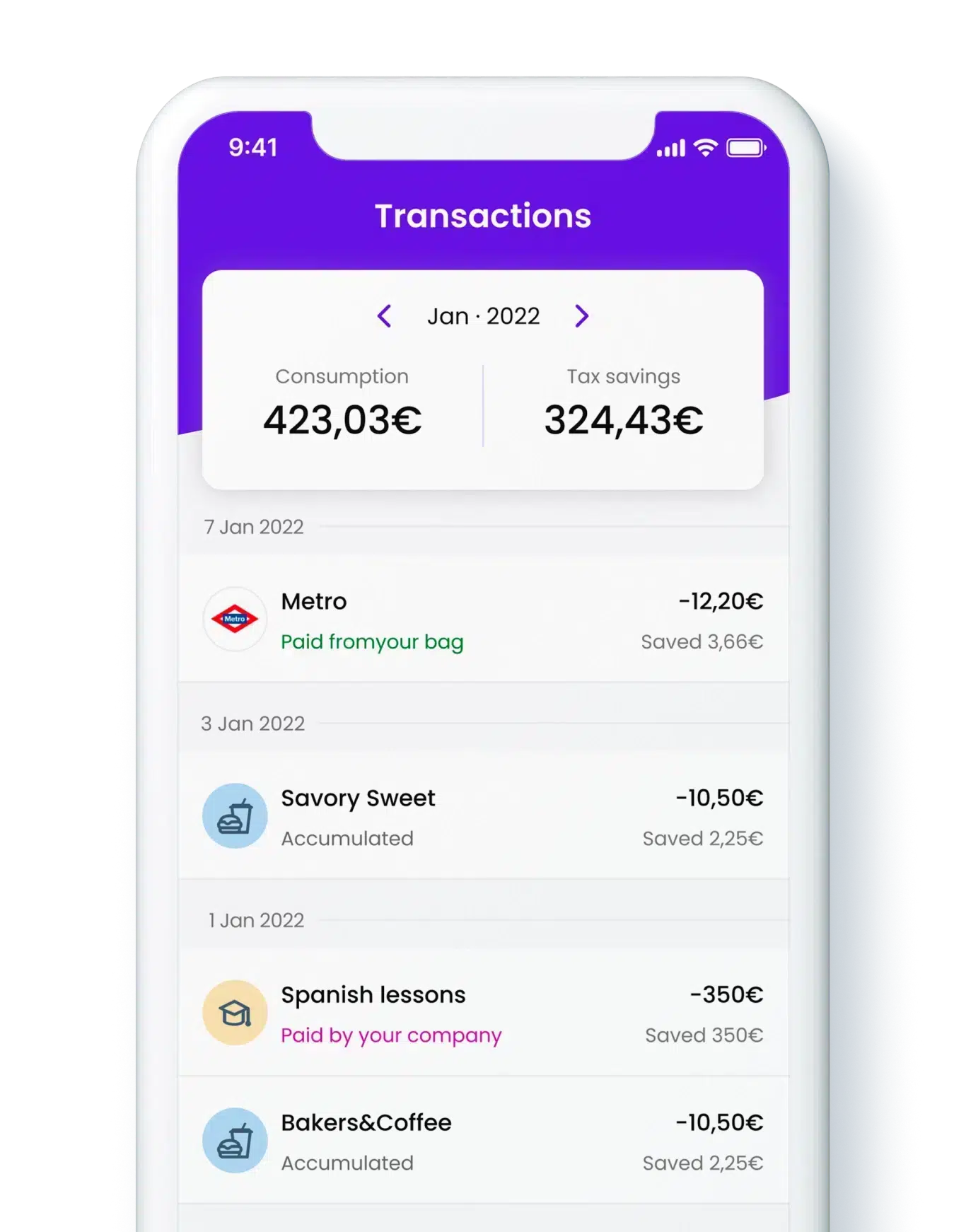

Create the perfect Benefits Plan for your company

Besides the nursery pass, with Cobee you can create a personalised Benefits and Flexible Remuneration plan for your teams. Discover all the advantages!

What our customers say

Request a demo

FAQs about the nursery voucher

With the card from Cobee, your teams can make use of their nursery card. With this benefit, they will enjoy limitless deductions from their taxable base for amounts spent on nursery schools.

Furthermore, the Cobee nursery voucher is compatible with other subsidies and can be used for both public and private nursery schools as long as they are legally recognised.

We want to make it even easier for you: unlike traditional nursery vouchers or other platforms, the Cobee revolution means there is no need for monthly top-ups. You can adjust the amounts whenever you want.

You will enjoy an all-in-one platform that is fully digital for tracking the status of each employee and therefore enable or disable their cards immediately, hassle-free.

With the nursery voucher, your workforce can deduct all the amounts they spend via their Benefits Plan from the figure used to calculate Personal Income Tax.

They can use the nursery voucher for both public and private nursery schools provided that they are legally recognised by the regional government authorities.

They just need to log in to the Cobee app, activate the service and choose a nursery school. We deal with everything else and your employees can start to save money from day one.

Yes, the nursery voucher is compatible with other public subsidies from the State and Regional Government authorities, including the one for working mums.

The benefit received via a nursery voucher or cheque is exempt from Personal Income Tax. As it is considered remuneration in kind, it is subject to its general limits. The total amount of remuneration in kind should not exceed 30% of the employee’s gross annual salary, and the salary in cash must be higher than the minimum guaranteed interprofessional wage (SMI).

The Cobee nursery voucher is compatible with any public or private nursery school that is legally recognised by the corresponding authorities

A clear financial benefit is achieved by using the nursery vouchers. Rather than spending money on nurseries from your wages, the amount is taken directly from your gross salary before tax. This simple change has a significant impact: the reduction to what you take home is much less than the actual amount transferred to the nursery care provider.

For example, an employee receives a monthly salary of €1,500. When spending €300 on nursery care, their “disposable” income following that deduction amounts to €1,200.

On the other hand, when using the nursery voucher system, the company takes those €300 from the employee’s gross salary and it is not included in the figure for calculating the Personal Income Tax withholding. This strategy has a two-fold effect: if the tax withholding rate were 15%, for example, the employee would be saving a total of €45 (15% of €300). They would therefore take home €1,245, and that is a real increase in their pocket.

Another advantage lies in the Personal Income Tax exemption applied to these nursery vouchers, which has important implications. This applies whether the vouchers constitute an addition to the salary or whether they are directly deducted. The ramifications are substantial.

Let’s use the example of an employee with a gross annual salary of €25,000 and one dependent child. Under normal circumstances, their Personal Income Tax withholding would amount to €3,065 per year. However, if the €3,000 spent every year on nursery care are channelled through this vouchers strategy, their taxable base would be calculated on a salary of €22,000. This would result in a smaller withholding of €2,312. That is clearly a considerable tax saving of more than €700 (equivalent to approximately three months of nursery costs).

It is important to stress that the vouchers system specifically relates to schooling costs and excludes other things like school equipment and transport, for example.