The training plan you need

Get the best training courses for your company so it can adapt to the latest requirements via your salary sacrifice plan. Enjoy tax advantages for your employees and the company.

Start training your teams!

All the advantages of a

training plan

Why choose a training plan?

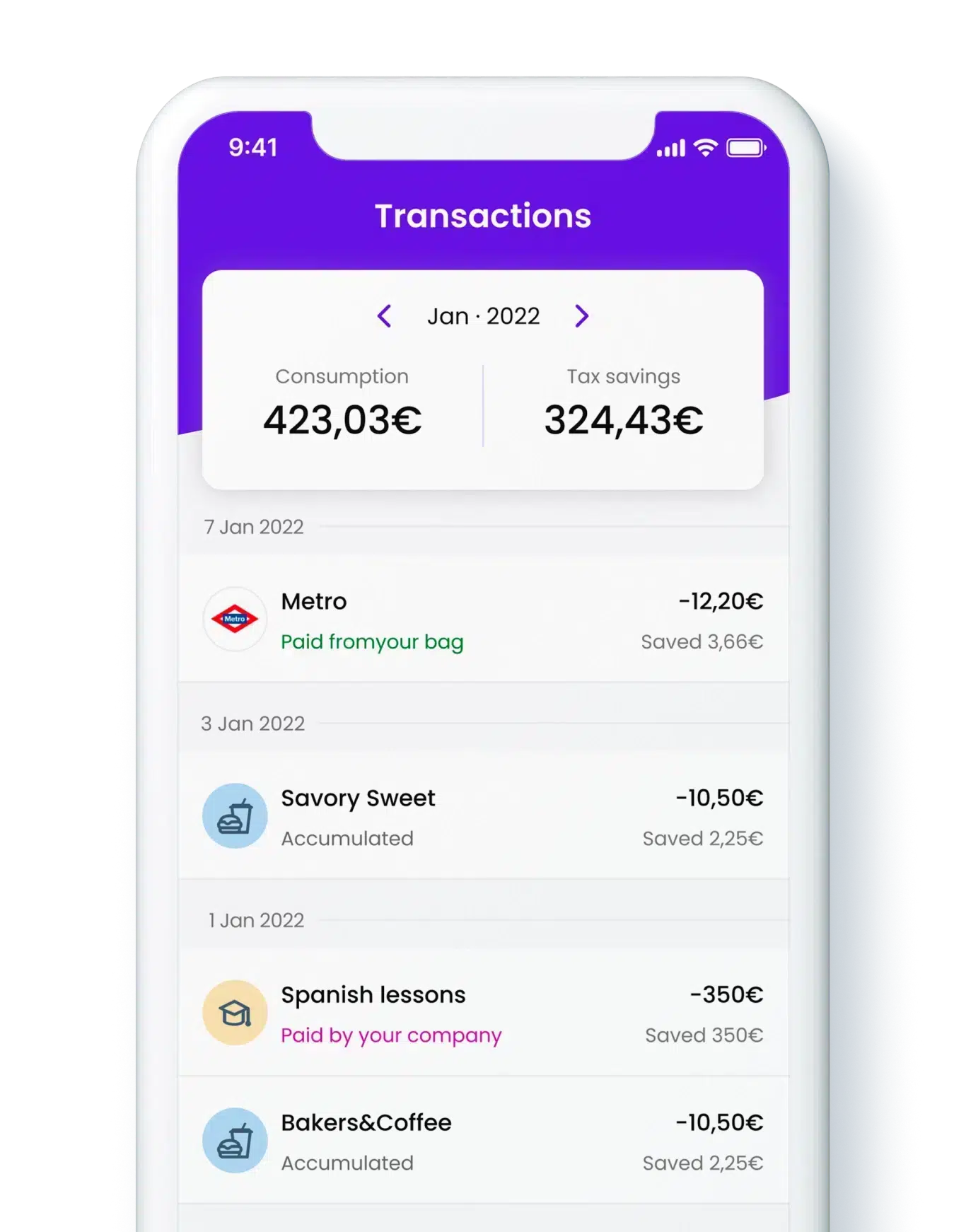

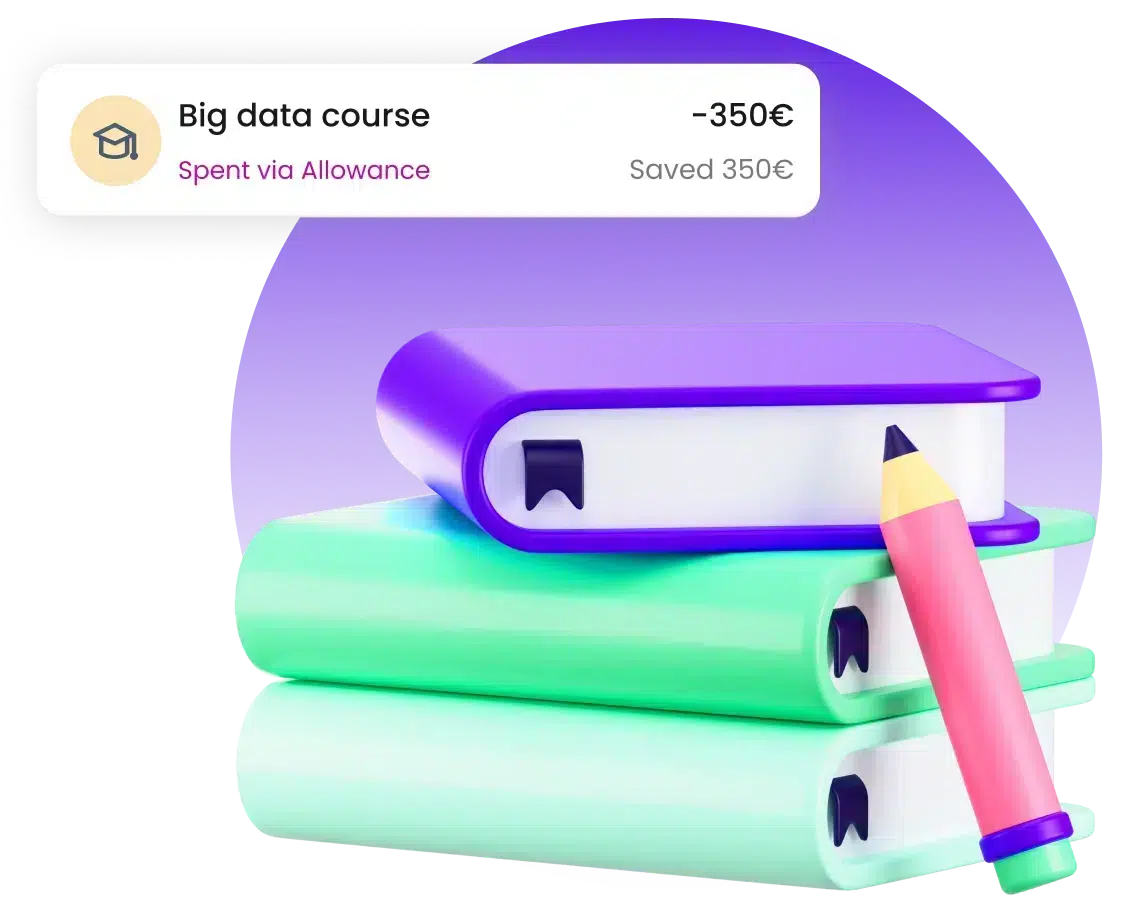

With Cobee, you can set up your training plan as Salary Sacrifice, a Company Benefit or a combination of both. Adopt the formula that best suits your company.

A genuinely unique experience in the market

Simplicity

Fully digital, intuitive and easy-to-use platform

Flexibility

No need for monthly top-ups

Savings

Tax benefits for company and workforce

Innovation

Physical card, virtual card and app for managing your benefits

Create the perfect Benefits Plan for your company

Besides the training plan, with Cobee you can create a personalised Benefits and Flexible Remuneration plan for your teams. Discover all the advantages!

What our customers say

Request a demo

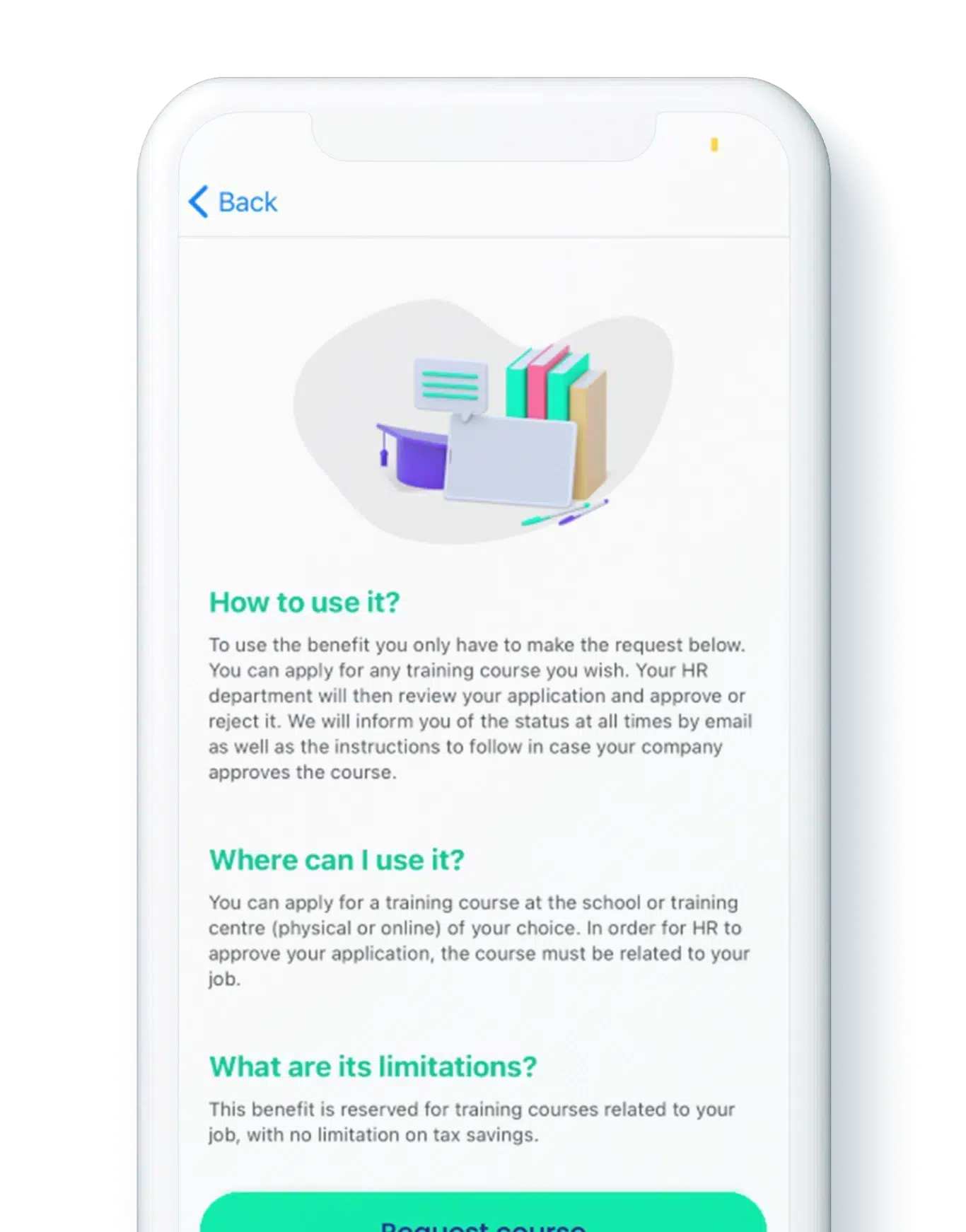

FAQ

A company training plan consists of a series of actions aimed at updating, retraining and renewing the skills and knowledge of the teams that make up that company in order to save time and money as well as boost productivity.

There are several reasons a training plan might be implemented at a company. Some of the advantages include:

– Professional and social training: employees not only improve their professional skills but their social skills as well by spending time with colleagues.

– Self-fulfilment: an important part of the employee experience is to offer them actions that will motivate them to achieve targets and fulfil aspirations. Training creates touchpoints or experiences with a positive knock-on effect on satisfaction at the company.

– Job performance: improving professional skills and interpersonal skills will enable employees to better perform their duties.

– Motivation: identifying skills in an employee and enhancing them is essential for that employee to reach a strong level of commitment to and satisfaction with the company. An employee with an active training plan will feel incentivised and challenged to continue developing their talent at the company.

Whether as Salary Sacrifice or a Company Benefit, there are no limits on how much money can be allocated to training plans. Any limits would be tied to the tax deduction, which cannot surpass 30% of each individual’s gross earnings.

Via Flexible Remuneration, people who take up training plans could benefit fiscally from a reduction to the taxable base used to calculate their Personal Income Tax. The most money they can deduct will be determined by that 30% limit.