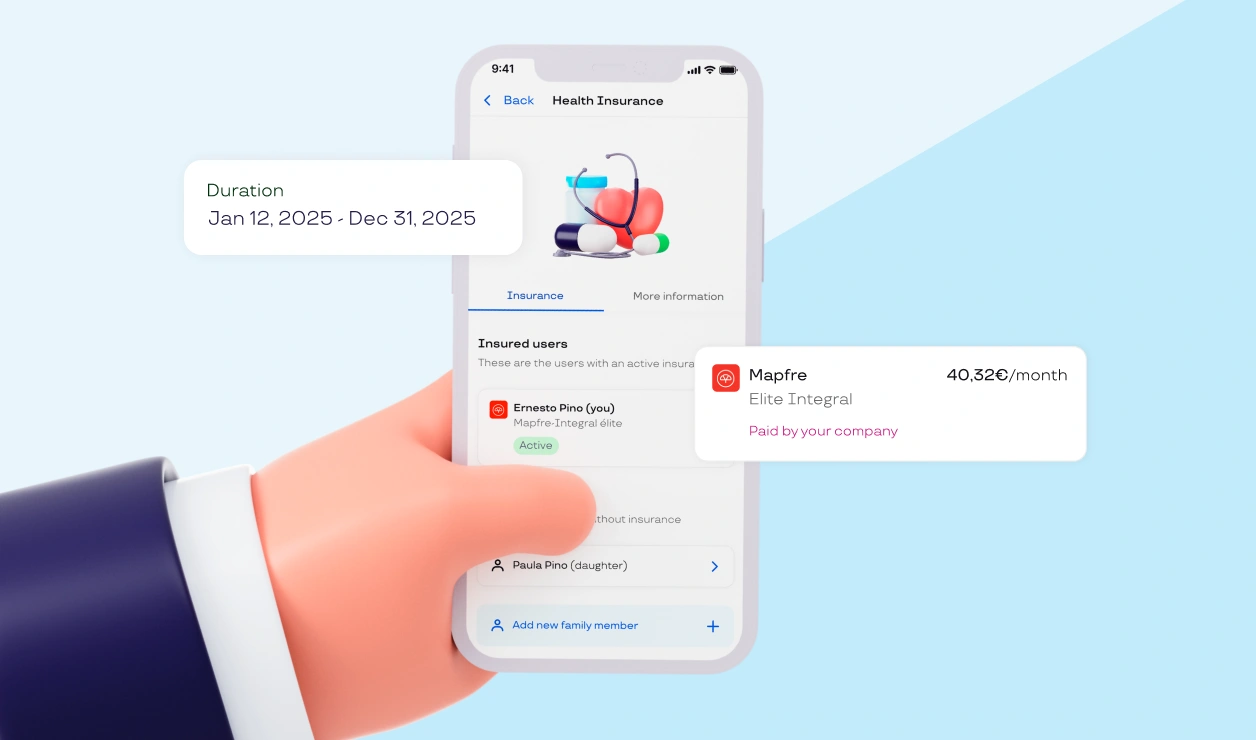

Company health insurance to suit everyone

- Look after your workforce with the most highly valued benefit: company health insurance.

- With Cobee by Pluxee, you’ll get a policy to suit the needs of your company and you’ll have access to the best professionals and healthcare centres..

Trusted by the likes of top companies

All the advantages of the health insurance

The most highly valued and most sought-after benefit for all employees.

With the reliability and advice of Cobee Broker.

Increased well-being at the company with the best care and the best professionals.

Complete flexibility: you can adapt the coverage to suit your needs.

Tax advantages for the company and users from day one.

With the best health insurance partners in Spain

Flexibility and all the options for your team’s well-being, with the largest insurance network in the country. Your employees can choose the insurance that best suits their needs. Conditions apply.

Flexibility

No need for monthly top-ups

Savings

Tax benefits for company and workforce

Simplicity

Fully digital, intuitive and easy-to-use platform

Thousands of companies have already joined Cobee by Pluxee

Join the benefits revolution and empower your team by offering the best benefits with Cobee by Pluxee.

Plans from

€1 employee/month

Find the perfect plan for your team as we show you the platform.

Request a demo

Health insurance FAQ

Health insurance has become the favourite Company Benefit among Spaniards according to the Cobee Benefits Report. With medical insurance products, companies successfully retain their talent because of all the advantages they provide to employees.

Besides the tax exemption of up to €500 per year, health insurance is a powerful tool for building employee loyalty and attracting the best talent. This type of policy also helps to significantly reduce employee absenteeism, thereby boosting productivity and well-being in employees.

With the company Health Insurance from Cobee, you’ll enjoy complete flexibility in adapting policies to the needs of your workforce.

You’ll have the best insurance companies in the market and the most comprehensive coverage options to meet the needs of your employees.

The tax exemption applicable to health insurance amounts to €500 per year in the Personal Income Tax calculation for each employee and €1,500 in the event of disability. Anything over that amount is taxed as remuneration in kind.

Furthermore, the company will also enjoy tax advantages as it can deduct 100% of the amount allocated to private health insurance products for its employees.