Discounts for all your teams

- Reward your employees and boost loyalty with discounts on products and services.

- Set up a plan to suit the needs of your company and let your employees start saving money immediately.

Trusted by the likes of top companies

All the advantages of discounts for your employees

Accessibility

You and your team can see all transactions and usage in real time from our app.

Save money

Save money and harness advantages when consuming products or services.

Flexibility

Create a plan to suit your team, build loyalty and attract the best talent

Flexibility

No need for monthly top-ups

Savings

Tax benefits for company and workforce

Simplicity

Fully digital, intuitive and easy-to-use platform

Thousands of companies have already joined Cobee by Pluxee

Join the benefits revolution and empower your team by offering the best benefits with Cobee by Pluxee.

Plans from

€1 employee/month

Find the perfect plan for your team as we show you the platform.

Request a demo

Employee discounts FAQ

Nowadays, there are three types of employee discounts:

Discounts as remuneration in kind: those that the company offers exclusively to its employees and that let them obtain goods or services at lower than market price. Salary or remuneration in kind lets the employee allocate a part of their wages to the payment of certain products in order to benefit from tax exemptions.

If the discount is more than 15% or the total discounts received by an employee in a single year surpass €1,000, anything above that amount is considered as remuneration in kind.

The special prices, terms and limits must be available to employees only. In other words, if the employee could have acquired a product for the same price as that provided by the company but via other deals, it would not be considered as remuneration in kind.

Ordinary or standard discounts: these are not exclusively offered to employees but are rather offered to other groups as well, who can acquire the products at the same price, under the same terms and with the same limits as employees of the company.

The following are considered as ordinary or standard discounts according to the law:

- Discounts offered to other groups with similar characteristics to company employees;

- Promotional discounts of a general nature valid at the time of providing the remuneration in kind;

- Any other besides the above, provided that it does not exceed 15% or €1,000 per year.

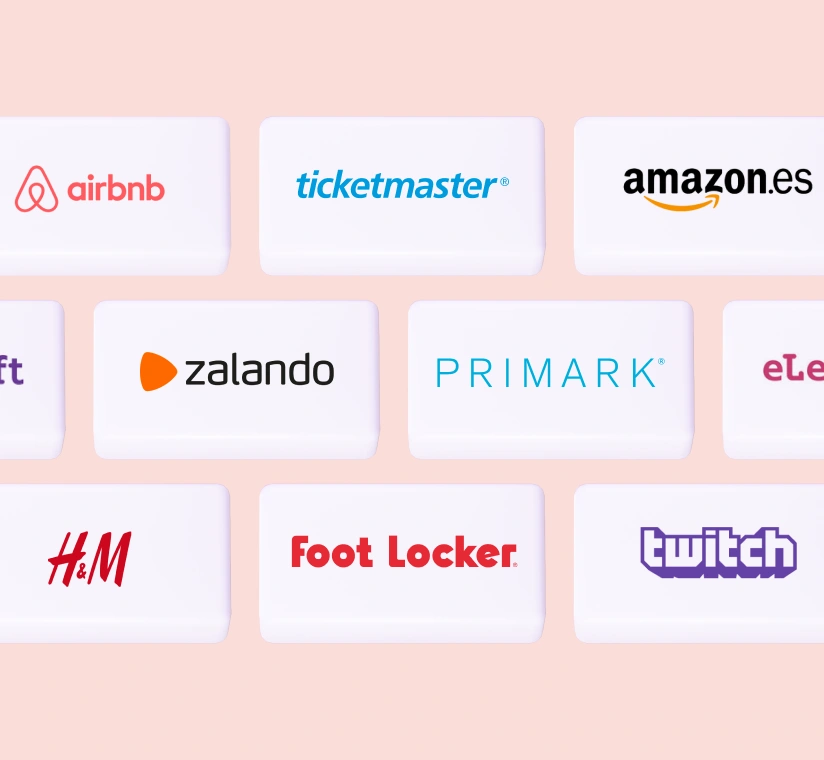

Employee discounts plans: access to exclusive discounts on a range of brands. These are usually offered via a portal used by the employee to gain direct access to the discounts in the form of coupons or discount codes.

In this case, the company may negotiate the discount package and brands included in advance or opt for a closed package.

There are several discount plan providers or benefits plan providers with which discount coupons would come as standard.

Discounts as remuneration in kind: those that the company offers exclusively to its employees and that let them obtain goods or services at lower than market price. Salary or remuneration in kind lets the employee allocate a part of their wages to the payment of certain products in order to benefit from tax exemptions.

Ordinary or standard discounts: these are not exclusively offered to employees but are rather offered to other groups as well, who can acquire the products at the same price, under the same terms and with the same limits as employees of the company.

Employee discounts plans: access to exclusive discounts on a range of brands. These are usually offered via a portal used by the employee to gain direct access to the discounts in the form of coupons or discount codes.