The pension plans you were looking for

Look after your employees’ future with the company pension plan from Cobee. Make significant savings and prepare for your retirement easily and hassle-free.

Start using Cobee!

All the advantages of a

pension plan

Why choose a pension plan?

With Cobee, you can complement your company’s Compensation Plan with the pension plan that best suits your workforce.

A genuinely unique experience in the market

Simplicity

Fully digital, intuitive and easy-to-use platform

Flexibility

No need for monthly top-ups

Savings

Tax benefits for company and workforce

Innovation

Physical card, virtual card and app for managing your benefits

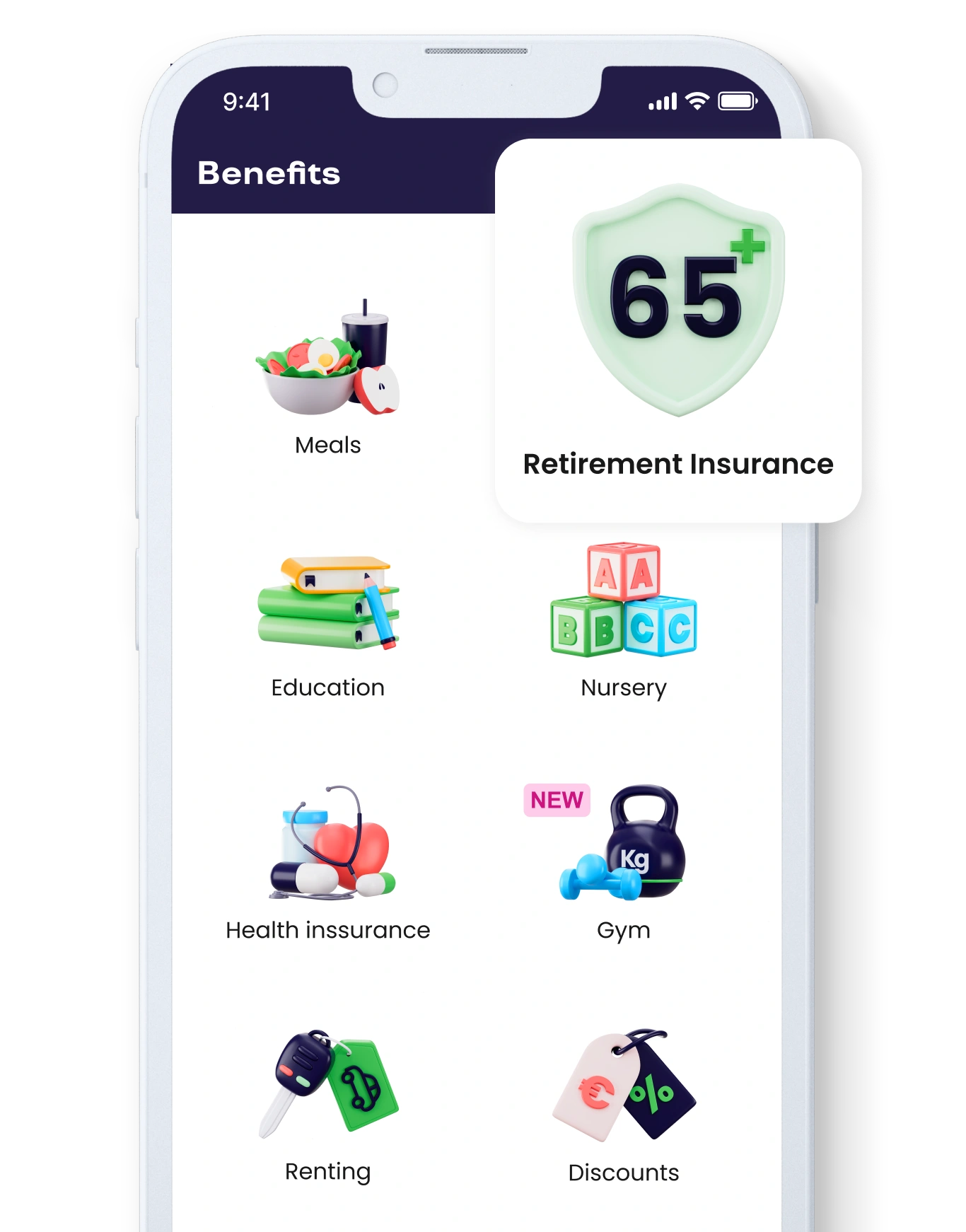

Create the perfect Benefits Plan for your company

Besides the pension plans, with Cobee you can create a personalised Benefits and Flexible Remuneration plan for your teams. Discover all the advantages!

What our customers say

Request a demo

FAQ

The Pension Plan Benefit is a long-term savings instrument. The objective is to generate sufficient savings to complete the public pension that employees will receive upon retirement.

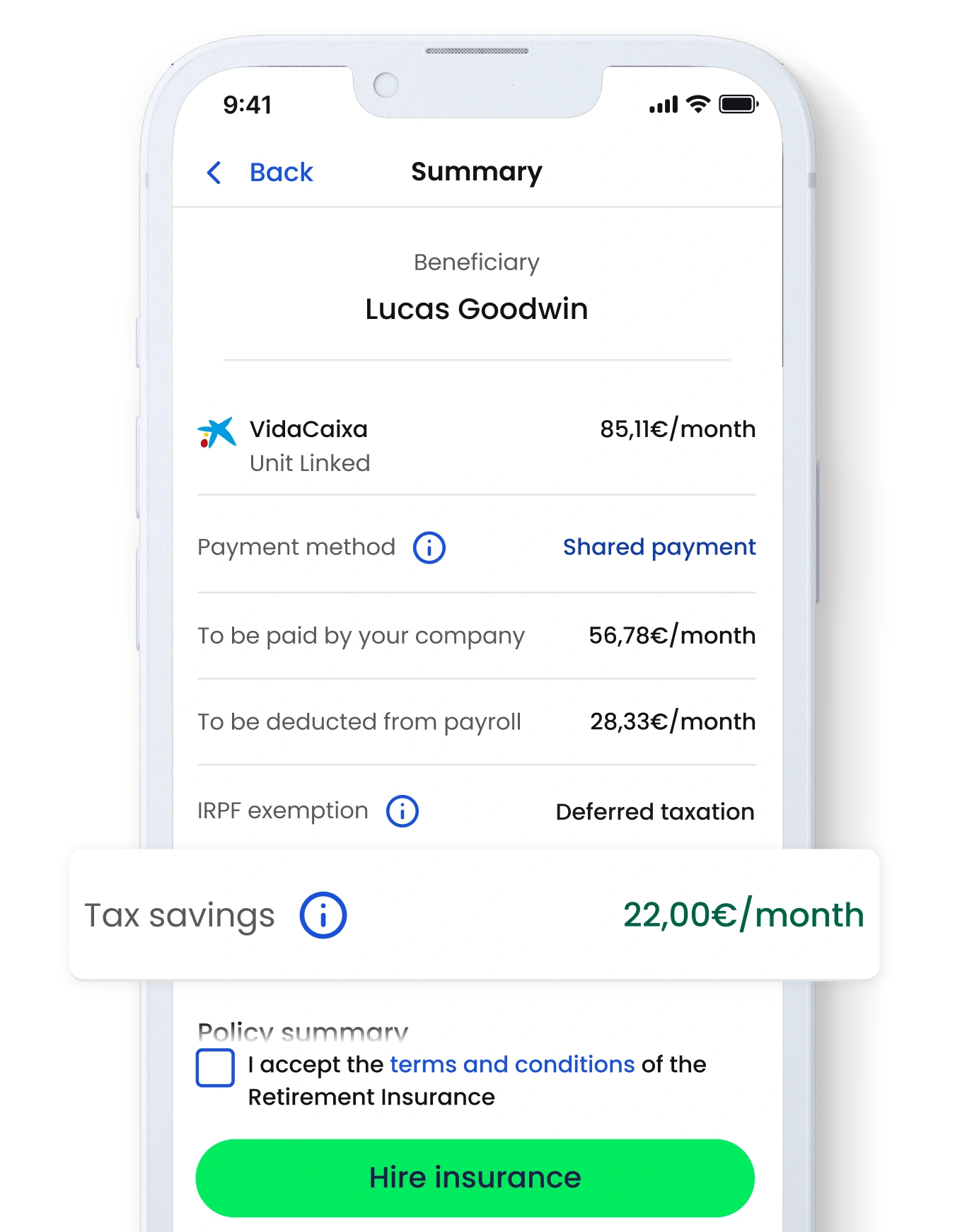

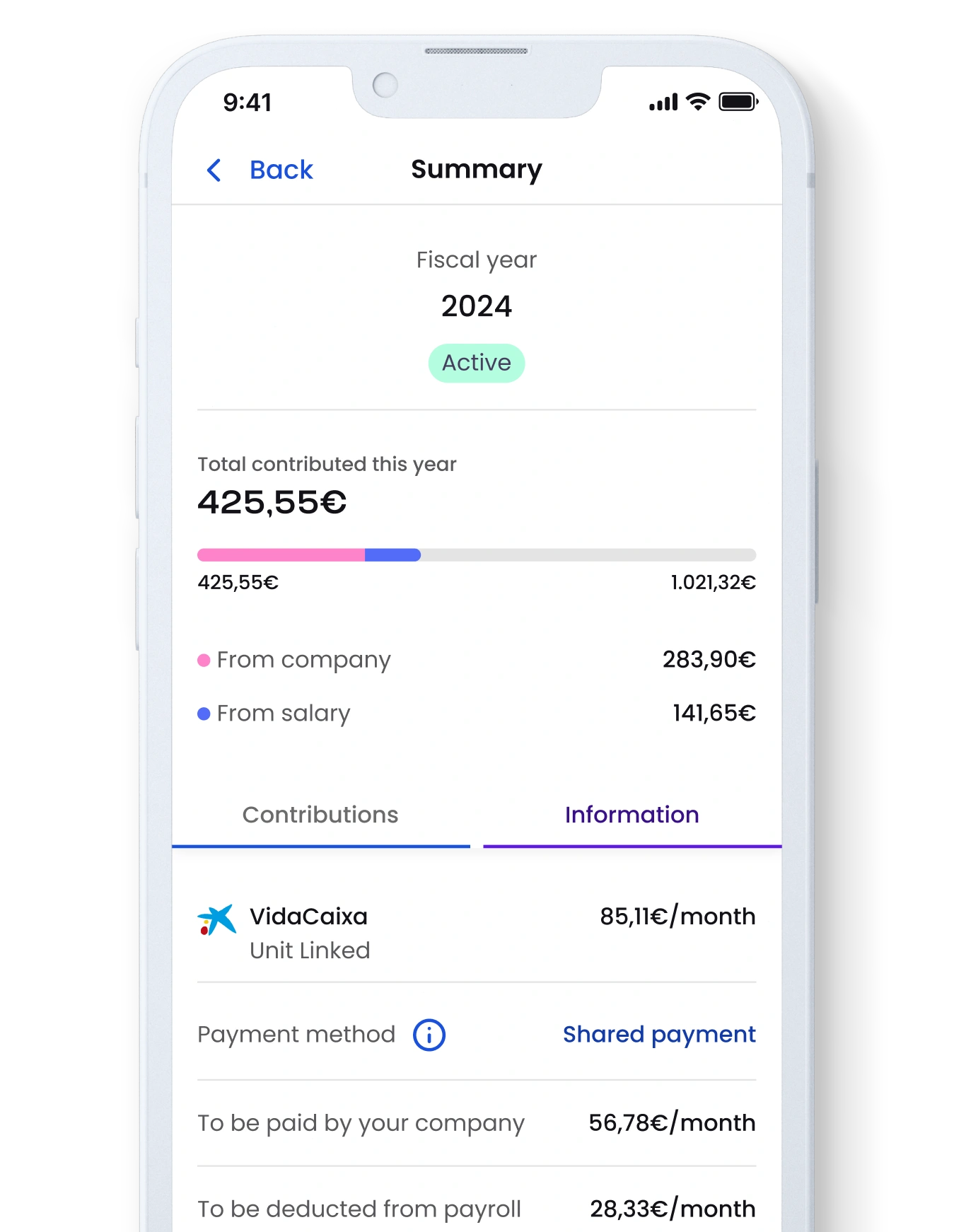

The company can contribute an annual maximum of €8,500, while employees can contribute up to €1,500 or 2.5 times the amount contributed by the company.

Whether as a Company Benefit or as Salary Sacrifice, both the company and the employee enjoy tax advantages. The company can deduct the amounts from its Corporate Income Tax calculation while the employee will see the contribution reflected on their payslip as ‘remuneration in kind’, meaning they will enjoy a reduction to the taxable base used to calculate their Personal Income Tax. The maximum deductible amount will be €10,000 per year (€1,500 from the employee and €8,500 from the company).

The main way in which people access the funds from a Pension Plan is by reaching the legal retirement age. Nonetheless, legislation also provides for other situations such as long-term unemployment or incapacity for work. Furthermore, as from 2025, it will also be possible to access these funds from the tenth year in which contributions began.

Yes, you can have more than one pension plan at the same time. However, the fiscal caps will be the same after all the contributions have been added together. In other words, if you already had a Pension Plan and now your company also wants to make contributions to another new one, you will be able to benefit from them both.